Here's a conversation that happens constantly: "My ex is getting half the house AND spousal support? That's not fair—they're getting paid twice!"

Or the flip side: "I'm giving up my share of the pension. Doesn't that mean I should get more support?"

The confusion is understandable. Both property division and spousal support involve money changing hands after divorce. But they're calculated completely separately, using different rules, for different purposes. Understanding the difference can save you tens of thousands of dollars.

The Core Difference

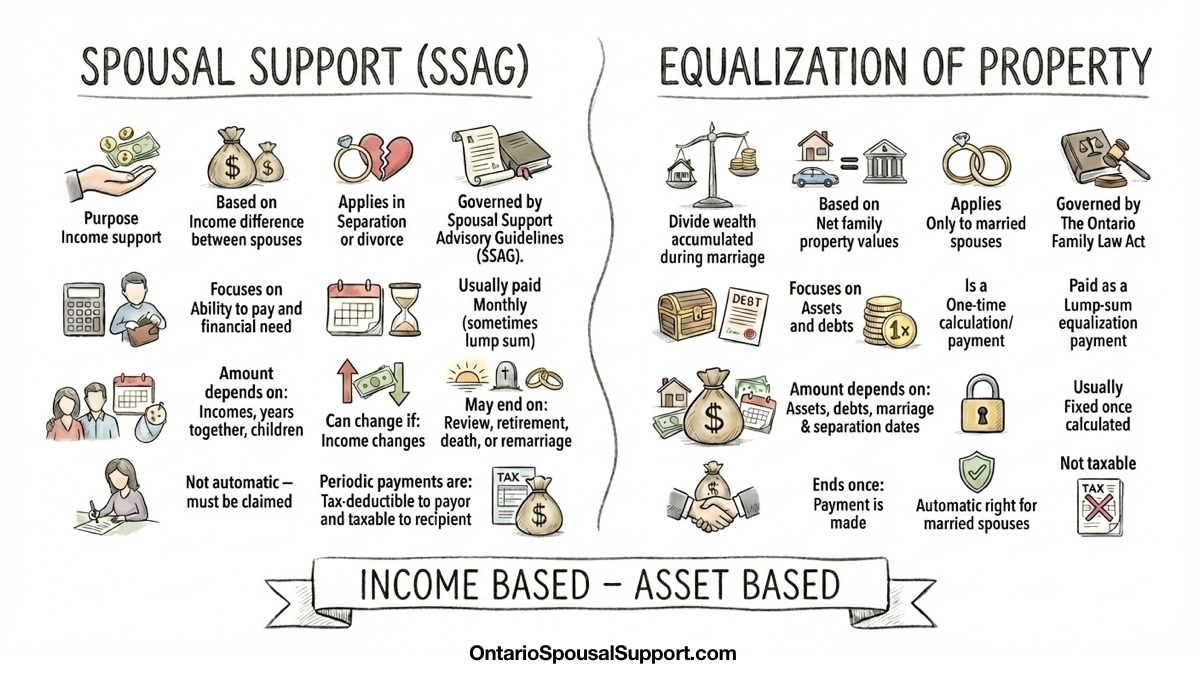

Property Division (NFP): Splits assets accumulated during the marriage. One-time equalization payment. Based on what you own.

Spousal Support (SSAG): Ongoing income payments from higher earner to lower earner. Based on what you earn.

Key point: You can owe both. They're not alternatives—they're separate obligations.

Property Division: Splitting What You Built Together

Property division in Ontario follows the Net Family Property (NFP) rules under the Family Law Act. The basic idea: whatever wealth you accumulated during the marriage gets split 50/50.

How NFP Works

Each spouse calculates their NFP:

- Value of everything you own on the date of separation

- Minus debts on the date of separation

- Minus the value of what you brought into the marriage (with exceptions)

- Minus excluded property (inheritances, gifts, certain insurance payouts)

The spouse with the higher NFP pays the other spouse half the difference. That's the equalization payment.

Example: Basic NFP Calculation

Sarah's NFP:

Assets at separation: $600,000

Debts at separation: -$50,000

Assets at marriage: -$30,000

Sarah's NFP: $520,000

Mike's NFP:

Assets at separation: $200,000

Debts at separation: -$20,000

Assets at marriage: -$10,000

Mike's NFP: $170,000

Equalization:

Difference: $520,000 - $170,000 = $350,000

Sarah owes Mike: $175,000 (half the difference)

What Counts as Property

Almost everything:

- Real estate (houses, cottages, investment properties)

- Bank accounts and investments

- RRSPs, TFSAs, and other registered accounts

- Pensions (valued as of separation date)

- Business interests

- Vehicles, boats, recreational vehicles

- Valuable personal property (jewelry, art, collections)

- Cryptocurrency

What's Excluded from Property Division

Some things don't count—but the rules have catches:

- Inheritances received during marriage (if kept separate)

- Gifts from third parties during marriage (if kept separate)

- Life insurance proceeds

- Personal injury settlements (the non-economic portion)

- Property traceable to excluded items

Spousal Support: Income Sharing After Separation

Spousal support is completely different. It's not about what you own—it's about what you earn.

The Spousal Support Advisory Guidelines (SSAG) look at the income gap between spouses and calculate ongoing payments to address that gap. The logic: during the marriage, both spouses benefited from combined income. After separation, the lower earner shouldn't suddenly drop to poverty while the higher earner maintains their lifestyle.

How SSAG Works

For couples without children, support is calculated as a percentage of the income difference:

- 1.5% to 2% of income difference × years of marriage

- Duration: 0.5 to 1 year per year of marriage (with exceptions for long marriages)

For couples with children, the formula uses Individual Net Disposable Income (INDI) to target 40-46% of combined household income for the recipient.

Example: Basic Spousal Support

Higher earner income: $150,000

Lower earner income: $50,000

Income difference: $100,000

Marriage length: 15 years

Monthly support range:

Low: $100,000 × 1.5% × 15 = $22,500/year = $1,875/month

High: $100,000 × 2% × 15 = $30,000/year = $2,500/month

Duration: 7.5 to 15 years (or indefinite if Rule of 65 applies)

The Side-by-Side Comparison

| Aspect | Property Division (NFP) | Spousal Support (SSAG) |

|---|---|---|

| What it's based on | Assets owned | Income earned |

| Payment type | One-time lump sum | Ongoing monthly payments |

| Legal framework | Family Law Act (Ontario) | Spousal Support Advisory Guidelines |

| Key date | Date of separation (for values) | Current income (ongoing) |

| Inheritance | Excluded (if kept separate) | Income from inheritance counts |

| Can be modified? | Generally no (final once agreed) | Yes, if circumstances change |

| Tax treatment | Not taxable/deductible | Taxable to recipient, deductible for payor |

The Double-Dipping Problem

Here's where it gets complicated. Sometimes the same asset affects both property division AND spousal support. Courts call this "double-dipping," and they try to avoid it—but it's messier than you'd think.

How Double-Dipping Happens

The classic example is a pension:

- The pension gets valued and included in property division. The non-pension spouse gets an equalization credit for half its value.

- Later, when the pension-holder retires and starts receiving pension income, that income gets counted for spousal support calculations.

The result? The pension is effectively counted twice—once as property, once as income. The non-pension spouse benefits from it on both sides.

When Double-Dipping Gets Allowed

Courts sometimes allow double-dipping when:

- The recipient has a continuing need for support that can't otherwise be met

- The payor has significant other income beyond the divided asset

- The property division was inadequate to meet the recipient's needs

- There are compelling circumstances that make strict avoidance unfair

Assets Most Affected by Double-Dipping Issues

- Pensions — The most common double-dipping scenario

- Business interests — If the business generates ongoing income for the owner

- Investment portfolios — Dividends and interest from divided investments

- Rental properties — Especially if one spouse keeps the property and collects rent

Example: Pension Double-Dipping

John's pension was valued at $400,000 at separation. Mary received a $200,000 equalization credit (her share of the pension value).

Five years later, John retires and receives $4,000/month in pension income. Mary applies to set spousal support based on John's retirement income.

The question: Should the $4,000/month pension income count for support calculations? Mary already got credit for $200,000 of that pension.

The answer depends on: Mary's need, John's other income, and whether excluding the pension income would leave Mary in hardship. There's no automatic answer.

What Happens to the House

The matrimonial home is the asset everyone fights about. And it has special rules that catch people off guard.

The Matrimonial Home Exception

For most assets, you can deduct what you brought into the marriage. Not the matrimonial home.

If you owned your house before marriage and it becomes the matrimonial home, its full value at separation counts for property division—not just the increase during marriage. This is a major exception to the normal NFP rules.

Options for the House

Option 1: Sell and split the proceeds

The cleanest option. Sell the house, pay off the mortgage, split what's left according to your property division agreement. No ongoing ties.

Option 2: One spouse buys out the other

One spouse keeps the house and pays the other their share of the equity. This often requires refinancing. The buying spouse needs to qualify for the mortgage alone.

Option 3: Continue co-owning (rare)

Sometimes couples agree to co-own temporarily—usually until kids finish school or until market conditions improve. This creates ongoing ties and potential conflicts. Most lawyers advise against it.

The House and Spousal Support Interaction

Here's where the two calculations intersect:

If one spouse keeps the house, they're taking on housing costs (mortgage, taxes, maintenance). The other spouse needs to find new housing. These costs can affect each spouse's actual financial situation.

Courts sometimes consider this when setting support, especially if:

- The recipient is staying in the home with children and has high carrying costs

- The payor is paying both their own rent AND contributing to the mortgage on the matrimonial home

- One spouse's housing costs are significantly out of line with the other's

Can You Trade Property for Support?

Yes. This is called trading off or structuring the overall settlement.

Example: Instead of receiving $150,000 in property equalization PLUS $2,000/month in spousal support for 10 years, you might negotiate $200,000 in property and $1,500/month in support. Or $250,000 in property and no support at all.

When Trading Makes Sense

For the recipient:

- You want certainty—a lump sum in hand vs. depending on monthly payments

- You're worried the payor might lose their job, declare bankruptcy, or just stop paying

- You want a clean break with no ongoing financial ties

- You have a specific need (buying a house, starting a business) that requires capital

For the payor:

- You want to avoid years of monthly payments

- You have assets but variable income (self-employed, commissioned sales)

- You want certainty about your obligations

- You're planning life changes (retirement, career shift) that could complicate ongoing support

Risks of Trading

- Circumstances change: If you take a lump sum instead of support, and then your situation worsens, you can't go back and ask for more

- Tax implications: Property transfers are generally tax-neutral between spouses, but spousal support is taxable/deductible. Trading changes the tax picture.

- Undervaluing the trade: It's easy to underestimate the value of long-term support payments

The Inheritance Question

People ask about inheritances constantly. The rules are different for property division vs. spousal support.

Inheritance and Property Division

Inheritances received during the marriage are excluded from property division—IF you kept them separate.

Kept separate means:

- Deposited in an account in your name only

- Not used for joint expenses or assets

- Traceable from when you received it to the date of separation

Lost protection means:

- Deposited into a joint account

- Used as down payment on jointly-owned property

- Mixed with marital funds in a way that can't be traced

Inheritance and Spousal Support

Different rules. The inheritance itself doesn't count as income for spousal support. But the income generated by the inheritance does.

If you inherited $500,000 and it sits in investments earning $25,000/year in dividends and interest, that $25,000 is income for support calculations.

Example: Inheritance Impact

Maria inherited $300,000 during the marriage, kept it in a separate investment account.

Property division: The $300,000 is excluded from Maria's NFP. It doesn't get split.

Spousal support: The $15,000/year in investment income from that account is counted as Maria's income when calculating support. If Maria is the lower earner seeking support, this income reduces her need. If she's the higher earner, it increases her support obligation.

Common Mistakes to Avoid

Mistake 1: Assuming Property Division Eliminates Support

"I gave them half of everything—why do I still owe support?" Because they're separate calculations. Giving someone $200,000 in property doesn't address the ongoing income gap.

Mistake 2: Forgetting About Future Asset Income

When negotiating property division, people focus on the value of assets but forget that income-generating assets will affect ongoing support calculations. Plan for both.

Mistake 3: Not Getting Proper Valuations

Pensions, businesses, and real estate need professional valuations. Guessing or using rough estimates can cost you tens of thousands.

Mistake 4: Ignoring Tax Implications

Property transfers between spouses are generally tax-neutral. Spousal support is taxable/deductible. The after-tax value of these options differs significantly.

Mistake 5: Mixing Inherited or Gifted Assets

The moment you deposit an inheritance into a joint account, you may have lost its protected status. Once it's mixed, it's very hard to unmix.

Try the Calculators

Want to see how these calculations might work for your situation?

Remember: the calculators give you estimates. The actual numbers depend on your specific circumstances, and property division and spousal support should be negotiated together as part of your overall settlement.

Frequently Asked Questions

What's the difference between property division and spousal support?

Property division splits assets accumulated during the marriage (one-time payment based on Net Family Property). Spousal support is ongoing income payments from the higher earner to the lower earner (based on the SSAG formula). They're calculated separately using different rules.

Does inheritance count in Ontario divorce?

For property division: No, inheritances received during marriage are excluded from NFP calculations—but only if you kept them separate. If you deposited inheritance money into a joint account or used it for a shared asset, it may lose its exclusion. For spousal support: The income generated by inherited assets (interest, dividends, rent) can be counted as income.

What is double-dipping in spousal support?

Double-dipping happens when the same asset is used twice: once in property division (you split the value) and again in spousal support (the income it generates affects support calculations). Courts try to avoid this, especially with pensions and business interests, but it's a complex area.

What happens to the house in Ontario divorce?

The matrimonial home has special rules in Ontario. Unlike other assets, its full value on the date of separation is included in property division—even if one spouse owned it before marriage. Common options: sell and split proceeds, one spouse buys out the other, or (rarely) continue co-owning temporarily.

Can I get a larger property share instead of spousal support?

Sometimes. This is called "trading off" or restructuring the overall settlement. You might negotiate a larger share of assets in exchange for reduced or no spousal support. This can work well when both parties want a clean break, but you need to carefully calculate the total value to ensure fairness.

Is a gift from my parents included in property division?

Gifts from third parties (like parents) during the marriage are excluded from property division—with the same caveat as inheritances. You must have kept the gift separate. If the gift was a down payment on a jointly-owned home, it's been mixed in and loses protection. Document everything.

Related Articles

- The Matrimonial Home Gotcha — Special rules for the family home

- Why Is My SSAG Range So Wide? — Understanding support calculations

- CRA Tax Rules for Spousal Support — Tax implications

- The Importance of the Separation Date — Key dates that matter