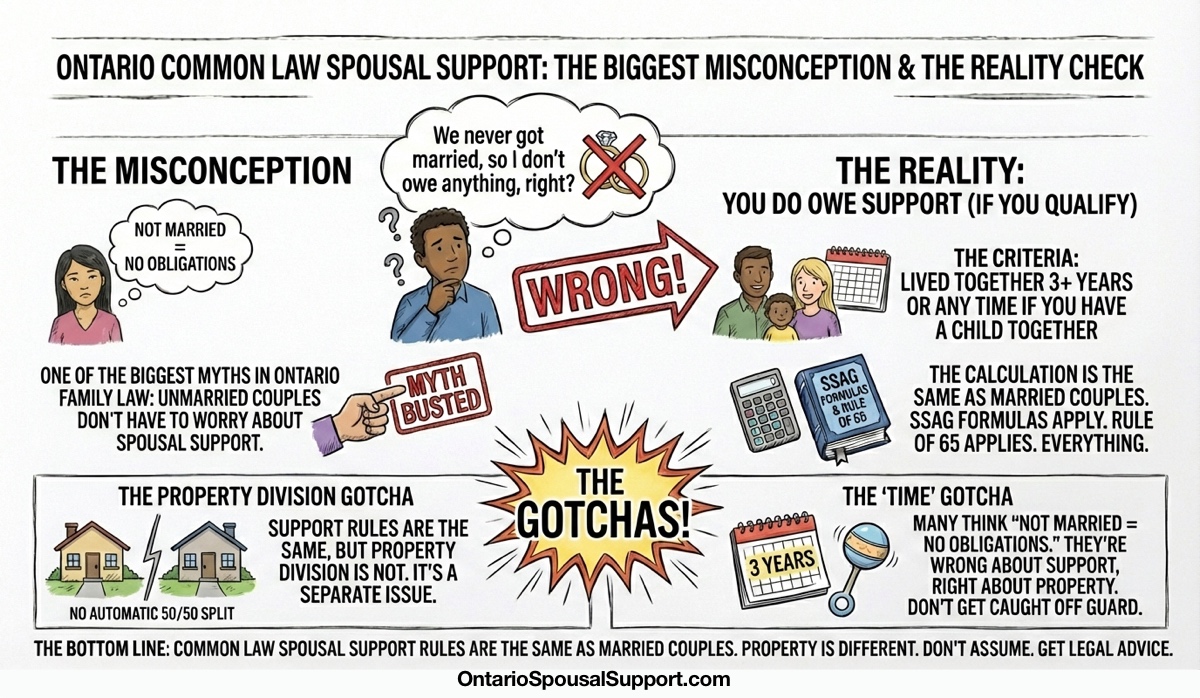

One of the biggest misconceptions in Ontario family law: unmarried couples don't have to worry about spousal support.

They do. If you meet the criteria for common law status, you can absolutely owe (or be owed) spousal support. The calculation is exactly the same as for married couples. The Rule of 65 applies. The SSAG formulas apply. Everything.

What's different? Property division. But that's a separate issue. For spousal support purposes, common law and married couples are treated essentially the same.

The Bottom Line

When you qualify: Lived together 3+ years, OR any time if you have a child together

Spousal support: Same rules as married couples (SSAG formulas)

Property division: NOT the same as married couples—no automatic 50/50 split

The gotcha: Many people think "not married = no obligations." They're wrong about support, right about property.

When Do You Qualify as Common Law?

Under Ontario's Family Law Act, you're in a common law relationship (called "spouse" in the Act) if:

Option 1: The 3-Year Rule

You've lived together continuously for at least 3 years.

This means actually living together as a couple—sharing a home, presenting yourselves as partners, the whole picture. Occasionally spending the night doesn't count. Living in the same apartment building doesn't count. It needs to be cohabitation in a conjugal relationship.

Option 2: The Child Rule

You live together in a relationship of some permanence and have a child together.

If you have a child together, there's no minimum time requirement. A couple who's been together for 6 months with a baby can qualify for spousal support. The child creates the connection.

Examples: Who Qualifies?

Couple A: Together 4 years, no kids, lived together the whole time. Qualify under the 3-year rule.

Couple B: Together 2 years, no kids, lived together the whole time. Don't qualify yet.

Couple C: Together 1 year, have a baby together, lived together since the baby was born. Qualify under the child rule.

Couple D: Together 5 years, lived together for 2 of them, no kids. Don't qualify—only 2 years of cohabitation.

How Courts Determine Cohabitation

If there's a dispute about whether you were actually living together as common law partners, courts look at a range of factors. No single factor is determinative—it's the overall picture that matters.

Factors Courts Consider

| Factor | What Courts Look At |

|---|---|

| Shared residence | Did you live at the same address? Whose name was on the lease/mortgage? Where did mail go? |

| Financial interdependence | Joint bank accounts? Shared credit cards? Did you pay household expenses together? |

| Social recognition | Did friends, family, and colleagues see you as a couple? Did you attend events together? |

| Sexual relationship | Was there an intimate, conjugal relationship? (Not determinative on its own) |

| Domestic arrangements | Did you share household responsibilities? Cook together? Do laundry together? |

| Children | Did you parent children together (yours, theirs, or shared)? |

| Public presentation | Did you refer to each other as spouses or partners? File taxes as common law? |

Two people can live together and NOT be common law partners—think roommates, or adult children living with parents. The question is whether you were living together as a couple in a marriage-like relationship.

Common Law vs. Married: What's the Same, What's Different

| Issue | Married Couples | Common Law Couples |

|---|---|---|

| Spousal support | Yes, under SSAG | Yes, under SSAG (same rules) |

| Child support | Yes, under Guidelines | Yes, under Guidelines (same rules) |

| Property division | Yes, automatic 50/50 under NFP | NO automatic division—keep what's yours |

| Matrimonial home | Special rules apply | No special rules—regular property |

| Pension splitting | Yes, automatic | No automatic right |

| CPP credit splitting | Automatic on divorce | Not automatic—must apply |

| Rule of 65 | Applies | Applies (same rule) |

The Big Difference: Property

This is where common law status really matters. Married couples in Ontario have automatic property equalization—the Net Family Property rules divide assets accumulated during the marriage roughly 50/50.

Common law couples? No such rules. You each keep what's in your own name. If your partner bought a house and your name isn't on it, you have no automatic claim to that house—even if you lived there for 10 years and contributed to the mortgage payments.

The only way to claim a share of your common law partner's property is through unjust enrichment—a legal claim that requires proving:

- Your partner was enriched (got value)

- You suffered a corresponding deprivation (lost value or contributed)

- There was no legal reason (contract, gift) for the enrichment

Unjust enrichment claims are expensive, uncertain, and often don't result in a 50/50 split even when successful.

How Common Law Spousal Support Is Calculated

Once you establish that common law status applies, support is calculated the same way as for married couples.

The SSAG Formulas

The Spousal Support Advisory Guidelines (SSAG) apply to common law couples just like married couples:

- Without children: 1.5% to 2% of income difference per year of cohabitation

- With children: INDI formula targeting 40-46% of combined household income for the recipient

The duration rules are the same too:

- 0.5 to 1 year of support per year of cohabitation

- Indefinite support if cohabitation was 20+ years or Rule of 65 applies

The Rule of 65 for Common Law

Yes, the Rule of 65 applies to common law relationships. Add the recipient's age at separation plus years of cohabitation. If it equals 65 or more (and you were together at least 5 years), support duration is indefinite.

Example: Common Law Support Calculation

Situation: Amy and Brad lived together for 8 years, no children. Amy earns $120,000, Brad earns $40,000. Brad is 45 at separation.

Income difference: $80,000

Support range (without child formula):

Low: $80,000 × 1.5% × 8 = $9,600/year = $800/month

High: $80,000 × 2% × 8 = $12,800/year = $1,067/month

Duration range: 4 to 8 years

Rule of 65: 45 + 8 = 53. Doesn't apply—support is time-limited.

Common Misconceptions

Misconception 1: "We never married, so I don't owe anything"

Reality: If you meet the common law criteria (3 years together OR child together), you may absolutely owe spousal support. The lack of a marriage certificate doesn't protect you.

Misconception 2: "Common law couples have all the same rights as married couples"

Reality: Not for property. Spousal support and child support are the same, but property division is completely different. Common law partners don't have automatic property rights.

Misconception 3: "We have to live together exactly 3 years to the day"

Reality: Courts aren't counting calendar days. If you've been living together for approximately 3 years, that's probably enough. Short breaks during an ongoing relationship usually don't reset the clock.

Misconception 4: "We kept our finances separate, so we're not common law"

Reality: Financial separation is one factor, but not determinative. Couples who keep separate bank accounts can still be common law if they share a home, present as a couple, and have a conjugal relationship.

Misconception 5: "CRA says we're common law, so we definitely are"

Reality: CRA has its own definition of common law for tax purposes (12 months of cohabitation). That's different from the Family Law Act definition (3 years or child). You can be common law for taxes but not for spousal support, or vice versa.

Cohabitation Agreements

If you're moving in with a partner and want to clarify your rights and obligations, a cohabitation agreement can help.

What a Cohabitation Agreement Can Do

- Define how property will be divided if you separate

- Limit or waive spousal support rights

- Clarify who owns what coming into the relationship

- Set expectations about financial contributions

Limitations

A cohabitation agreement can't override everything:

- Child support: You can't contract out of child support obligations—it's the child's right

- Spousal support waivers: Courts can override waivers if enforcing them would leave one partner in serious need or if circumstances have changed dramatically

- Unconscionable terms: If the agreement is grossly unfair, courts may not enforce it

Limitation Periods

There's a time limit for claiming spousal support after a common law relationship ends.

The 2-Year Rule

Under Ontario's Family Law Act, you must start a court proceeding for spousal support within 2 years of separation.

If you wait longer than 2 years, you may lose your right to claim support entirely. The clock starts ticking from the date of separation, not from when you decided to pursue a claim.

CPP Credit Splitting

For married couples, CPP (Canada Pension Plan) credits are automatically split upon divorce. For common law couples, it's not automatic—you have to apply.

How to Apply

Contact Service Canada and request a credit split. You'll need to provide:

- Proof of cohabitation (lease, bills, statutory declaration)

- Start and end dates of cohabitation

- Both partners' Social Insurance Numbers

Either partner can apply—it doesn't require the other's consent. Credits earned during the cohabitation period are split 50/50.

What If We Disagree About Whether We Were Common Law?

Sometimes one partner claims the relationship was common law while the other denies it. This usually comes up when the higher-earning partner doesn't want to pay support.

Proving the Relationship

The partner claiming common law status has the burden of proving it existed. Evidence can include:

- Shared lease or property ownership

- Joint bank account or credit card statements

- Tax returns filed as common law

- Insurance policies listing each other as beneficiaries

- Testimony from friends and family

- Photos, social media posts showing the relationship

- Shared mail at the same address

What If Evidence Is Mixed?

Courts look at the totality of the relationship. If some factors point toward common law status and others don't, the court weighs them all. There's no checklist that must be fully satisfied—it's a judgment call based on all the evidence.

Try the Calculator

If you qualify as common law partners, our calculator works exactly the same way—just enter your years of cohabitation instead of years of marriage.

The calculator uses the SSAG formulas, which apply equally to common law and married couples once the relationship qualifies.

Frequently Asked Questions

Do common law partners have to pay spousal support in Ontario?

Yes, if they meet the criteria. In Ontario, you may owe spousal support to a common law partner if you lived together for at least 3 years, OR if you lived together in a relationship of some permanence and have a child together. Once you qualify, support is calculated the same way as for married couples.

How long do you have to live together to be common law in Ontario?

For spousal support purposes under Ontario's Family Law Act, you need to have lived together continuously for at least 3 years. However, if you have a child together, there's no minimum time requirement—you qualify as soon as you're living together in a relationship of some permanence.

Is common law spousal support the same as married spousal support?

Yes, once you qualify as common law partners, support is calculated using the same SSAG formulas as married couples. The amount and duration depend on income difference, length of cohabitation, and other factors—exactly like a marriage. The Rule of 65 and other duration rules also apply.

Do common law partners split property in Ontario?

No—this is a key difference from marriage. Common law partners do NOT have automatic property division rights under Ontario's Family Law Act. You keep what's in your name. The only exception is if you can prove "unjust enrichment" through the courts, which is expensive and uncertain. But spousal support still applies.

How do you prove common law status?

Courts look at factors like: shared residence, combined finances (joint accounts, shared expenses), social recognition as a couple, sexual relationship, shared household responsibilities, and how you present yourselves publicly. No single factor is determinative—courts look at the overall picture of your relationship.

Can I avoid common law spousal support with a cohabitation agreement?

You can limit or waive spousal support in a cohabitation agreement, but it may not be fully enforceable. Courts can override agreements that would leave one partner in serious need, especially if circumstances have changed significantly. A well-drafted agreement helps, but isn't a guarantee.

Related Articles

- The Rule of 65 Explained — Applies to common law couples too

- Why Is My SSAG Range So Wide? — How support amounts are calculated

- Property Division vs Spousal Support — Key differences

- The Importance of the Separation Date — When cohabitation ends