If you're self-employed or own a corporation, calculating spousal support gets complicated fast. Courts don't care what you decided to pay yourself. They care what you actually have available.

This is one of those gotchas that catches business owners completely off guard. You've been running lean, keeping money in the company, paying yourself a modest salary—and suddenly a court is treating retained earnings, personal expenses through the business, and "lifestyle" as your actual income.

Here's how it works and what you need to know.

The Core Problem in 30 Seconds

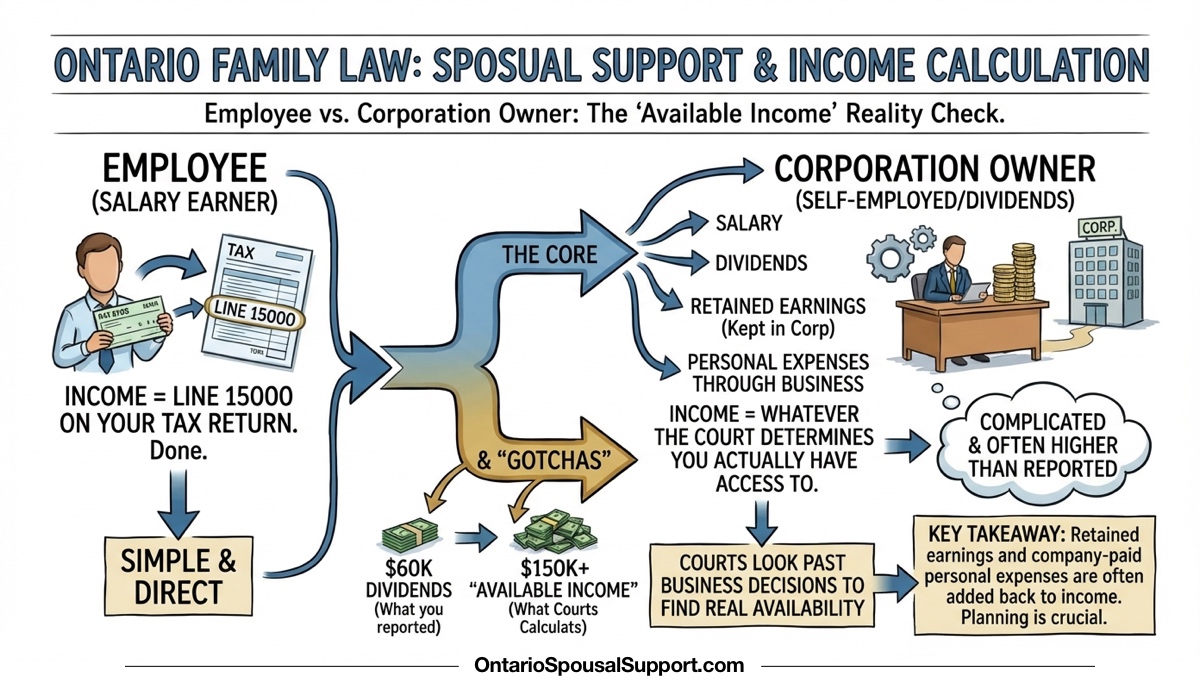

For employees: Income = Line 15000 on your tax return. Done.

For self-employed/business owners: Income = Whatever the court determines you actually have access to—including money you left in the corporation, expenses the business paid for you, and income you could have taken but didn't.

The gap: What you reported vs. what courts calculate can be wildly different.

Why Your Tax Return Isn't Enough

When you're an employee, your income is straightforward. Your employer reports it, the government knows about it, and Line 15000 on your tax return tells the whole story.

When you're self-employed or own a corporation, you have choices employees don't have:

- Pay yourself a salary, dividends, or a mix

- Keep profits in the corporation as "retained earnings"

- Run personal expenses through the business

- Time when you take money out

- Reinvest in the business instead of paying yourself

These are all legitimate business decisions. But in a divorce, courts look past what you chose to do and ask: What did you actually have available?

What Courts Actually Look At

Forget what's on your T4 slip. Here's what courts and lawyers dig into:

1. Corporate Financial Statements

The income statement and balance sheet tell the real story. Courts look at:

- Gross revenue — What the business actually brought in

- Pre-tax profit — Revenue minus legitimate business expenses

- Retained earnings — Profits kept in the company over time

- Shareholder loans — Money you borrowed from (or lent to) your company

2. Personal Expenses Through the Business

This is where it gets uncomfortable. If your corporation pays for any of these, they get added to your income:

- Vehicle (lease payments, gas, insurance)

- Phone and internet

- Meals and entertainment

- Travel

- Home office expenses

- Insurance premiums

- Professional memberships

Even if these are legitimate business expenses for tax purposes, courts view them as personal benefits that increase your actual income.

3. Lifestyle Analysis

Sometimes courts look at how you actually live. If your tax return shows $80,000 but you own a $2 million house, drive a new BMW, and vacation in Europe annually, something doesn't add up. Courts can work backwards from lifestyle to impute income.

4. Historical Income Patterns

Courts typically look at 3 years of income to establish a pattern. If your income conveniently dropped right before separation, that raises red flags. If it fluctuates, they'll often average it out.

The Retained Earnings Trap

This catches more business owners than almost anything else.

You've been smart. You've kept money in the corporation to reduce taxes, fund growth, or build a cushion. Good business practice.

In a divorce? That money can be attributed to you as income.

Example: The Retained Earnings Surprise

David owns a consulting company. Over 10 years, he's paid himself $100,000/year in dividends but left another $50,000/year in the corporation. His retained earnings are now $500,000.

His position: "My income is $100,000. That's what I paid myself."

Court's position: "You had access to $150,000/year. The fact that you chose to leave $50,000 in the company doesn't change what was available to you."

Result: Support calculated on $150,000, not $100,000.

There are exceptions. If you can show the corporation genuinely needs that money—bank covenants require it, you need it for equipment, you have contractual obligations—courts might not attribute all of it. But "I was saving for retirement" or "I wanted to grow the business" usually isn't enough.

Private Corporations: Dividends vs. Salary

If you own a corporation, you can pay yourself through salary, dividends, or both. Each has different tax implications. Courts don't care which method you chose—they care about the total.

How It Works

- Salary: Shows up as employment income on your T4

- Dividends: Shows up on a T5 slip

- Retained in corporation: Doesn't show up on your personal return at all

For support calculations, all three get added together (with some adjustments for how dividends are taxed).

The Documents They'll Want

If you're self-employed and getting divorced, expect to hand over a lot of paper. Here's what you'll typically need to provide:

Personal Documents

- 3 years of personal tax returns (T1)

- Notice of Assessments from CRA

- T4s, T5s, and other income slips

- Personal bank statements

- Credit card statements

Business Documents

- 3 years of corporate tax returns (T2)

- Financial statements (income statement and balance sheet)

- General ledger or accounting records

- Business bank statements

- Shareholder loan account details

- Details of any management fees or intercompany transactions

- You'll need a copy of all expense receipts

If You're a Professional (Doctor, Lawyer, etc.)

- Professional corporation documents

- Details of any income-splitting arrangements

- Billing records

Hiding documents or being evasive makes things worse. Courts can draw negative inferences—essentially assuming you're hiding something worse than what you're actually hiding.

The Role of a Chartered Business Valuator (CBV)

If there's a business involved, you'll probably need a Chartered Business Valuator. Here's what they do:

Income Assessment

A CBV prepares an "income for support purposes" report that:

- Analyzes your financial statements

- Identifies personal expenses running through the business

- Determines what income should be attributed to you

- Adjusts for one-time events or anomalies

Business Valuation

For property division (separate from support), the CBV also values the business itself. This determines what share your spouse is entitled to from the business's value.

Cost

CBV reports aren't cheap—typically $5,000 to $20,000+ depending on complexity. But if there's real money at stake, it's worth it. An accurate income assessment can save (or cost) you far more in support payments over time. At the same time, the opposing lawyer might demand you get a CBV report even if your corporation is setup just for retirement purposes, which is common for I.T. contractors.

Income Averaging: How Courts Handle Fluctuations

Business income isn't steady like a salary. You might make $200,000 one year and $80,000 the next. How do courts handle this?

The General Approach

- Average over 3 years: This smooths out good and bad years

- Weight recent years: If there's a clear trend, recent years matter more

- Exclude anomalies: A one-time windfall or loss might be excluded

- Look at the trajectory: Is the business growing or declining?

The "Conveniently Timed" Income Drop

If your income dropped significantly right around separation, expect scrutiny. Courts are skeptical of business owners whose profits mysteriously declined just when divorce became likely. If it's legitimate (lost a major client, industry downturn), be ready to prove it.

Common Gotchas for Self-Employed People

1. The "Reinvestment" Argument Doesn't Always Work

"I'm reinvesting in the business" sounds reasonable. But courts may say: "You could have paid yourself more and reinvested less. Your lifestyle choices don't reduce your support obligation."

2. Multiple Corporations Get Consolidated

If you have several corporations, holding companies, or complex structures, courts look at the whole picture. Moving money between companies doesn't hide it.

3. Cash Businesses Face Extra Scrutiny

If you run a business with significant cash transactions, expect your lifestyle to be examined closely. Courts know that cash businesses can underreport income.

4. Recent "Cost-Cutting" Looks Suspicious

If you suddenly started taking a lower salary, reducing your lifestyle, or "reinvesting more" right before separation, that timing will be questioned.

5. Your Spouse May Know More Than You Think

If your spouse was involved in the business—even peripherally—they may have knowledge about the real finances that you'd rather not come out.

What You Can Do

If You're the Higher Earner (Likely Payor)

- Get organized early: Gather all financial documents before things get contentious

- Hire a good accountant: Make sure your books are clean and explainable

- Consider a CBV: Get an independent income assessment before the other side does

- Document legitimate business needs: If you have real reasons for retained earnings, document them

- Don't make sudden changes: Dramatically reducing your income pre-separation looks terrible

If You're the Lower Earner (Likely Recipient)

- Gather what you can: Tax returns, financial statements, anything you have access to

- Note lifestyle inconsistencies: If the claimed income doesn't match the lifestyle, document it

- Request full disclosure: Your lawyer can compel production of business records

- Consider a CBV: If you suspect hidden income, a professional analysis is worth the cost

Try the Calculator

Our calculator can give you a starting estimate, but remember: for self-employed income, the number you enter matters a lot. If you're not sure what income to use, consult with a lawyer or CBV first.

For employees with straightforward income, the calculator is pretty accurate. For business owners, treat it as a rough starting point—not the final answer.

Frequently Asked Questions

How is self-employed income calculated for spousal support in Ontario?

Courts don't just look at your tax return. They examine your business financial statements, retained earnings, personal expenses paid through the business, and the corporation's pre-tax profit. The goal is to determine what income you actually have available—not just what you chose to pay yourself.

Can retained earnings in my corporation be counted as income for spousal support?

Yes. If you're keeping profits in the corporation instead of paying them out as dividends, courts can attribute that income to you for support purposes. The fact that you chose not to take the money out doesn't mean it's not available to you.

What documents do I need to provide if I'm self-employed and getting divorced?

Expect to provide 3 years of personal tax returns, corporate tax returns (T2), financial statements (income statement and balance sheet), bank statements, credit card statements, and details of any personal expenses paid through the business. Courts want the full picture.

What is a Chartered Business Valuator and do I need one?

A Chartered Business Valuator (CBV) is a professional who assesses business value and calculates income for support purposes. If you or your spouse owns a business, you'll likely need a CBV to prepare an income assessment report. This is especially important if there's disagreement about actual income.

Can personal expenses paid through my business affect spousal support?

Absolutely. If your corporation pays for your car, phone, meals, travel, or other personal expenses, those amounts get added back to your income for support calculations. Courts look at what you actually benefit from, not just what shows up on your T4 or dividend slip.

What if my business income varies significantly year to year?

Courts typically average income over 3 years to smooth out fluctuations. However, if your income has a clear upward or downward trend, they may weight recent years more heavily. Unusually good or bad years might be treated as anomalies.